Table Of Content

- What can you afford to spend on a house? Try our SoCal-specific calculator.

- Average Down Payment for First-Time Home Buyers

- How To Apply For A Mortgage

- In the first three months of 2021, 21% of buyers of existing homes made all-cash purchases

- buying a homeBuying a home as a single person

- hash-markAverage House Down Payments Bottom Line

The minimum down payment requirement for jumbo loans is typically set at 10% or higher. Saving up a big enough down payment to purchase a home is hard enough, but things only get worse when housing prices continue climbing year after year. Unfortunately, that's the exact situation homebuyers of all age groups are in right now.

What can you afford to spend on a house? Try our SoCal-specific calculator.

California First-Time Home Buyer 2024 Program & Grants - The Mortgage Reports

California First-Time Home Buyer 2024 Program & Grants.

Posted: Fri, 19 Apr 2024 07:00:00 GMT [source]

We are continuously working to improve the accessibility of our web experience for everyone, and we welcome feedback and accommodation requests. If you wish to report an issue or seek an accommodation, please contact us at Equity refers to the difference between the amount you owe on your mortgage and how much your home is worth. If you owe $200,000 on your mortgage and your home is worth $300,000, then your equity is $100,000.

Average Down Payment for First-Time Home Buyers

One of your top priorities when buying a house is probably having enough cash on hand to meet the down payment requirement. You may wonder how much you need to save for a down payment, or if buying a home without one is possible. There are many home buyer assistance programs available through state and local governments.

How To Apply For A Mortgage

Most of these programs are designed for first-time home buying, but repeat buyers can often qualify when they haven’t owned a home for the past three years. Also, while you’re saving up your 20% down, house prices may be increasing — so you’re chasing a moving target. The right down payment for you will depend on your loan program and your financial goals.

How much should you put down on a house for each loan type?

Start with a home affordability calculator (like the one below) to get a feel for how much you’ll need to put down and other expenses. Common mortgage types that fall into this home loan category include the 5/1 ARM, the 7/1 ARM and the 10/1 ARM. Our evaluations and opinions are not influenced by our advertising relationships, but we may earn a commission from our partners’ links.

The average down payment on a house is lower than many Americans might think. The oft-cited “20% rule” is a misconception, likely spurred by the fact that many lenders require private mortgage insurance when borrowers put down less than 20%. In fact, most conventional mortgages require as little as 3% down up front, meaning you may be able to start building equity sooner than you thought. How much you should put down on a house depends on the type of loan you’re applying for and your financial situation.

This content is created independently from TIME’s editorial staff. All-cash sales made up a quarter of all home sales in April 2021 compared to just 15% of sales in April 2020. “Expert verified” means that our Financial Review Board thoroughly evaluated the article for accuracy and clarity. The Review Board comprises a panel of financial experts whose objective is to ensure that our content is always objective and balanced.

First-time homebuyers can

But buyers should only employ their 401(k) if they know they are secure in their career. When receiving a gift toward a down payment on a home, it is important to document it appropriately. If you are lucky enough to have a generous family member, ask your real estate agent and mortgage lender in advance what information they will require to document the down payment gift. Making a 12% investment on a median-priced house in California (as of summer 2022) would equal a down payment of just over $100,000.

hash-markAverage House Down Payments Bottom Line

Your debt-to-income ratio (DTI) refers to the percentage of your monthly income that goes toward paying off debt. Since lenders look at DTI to make lending decisions, having a high DTI can keep you from qualifying for other loans in the future. The down payment is the portion of the home’s purchase price that you pay upfront and is not financed through a mortgage.

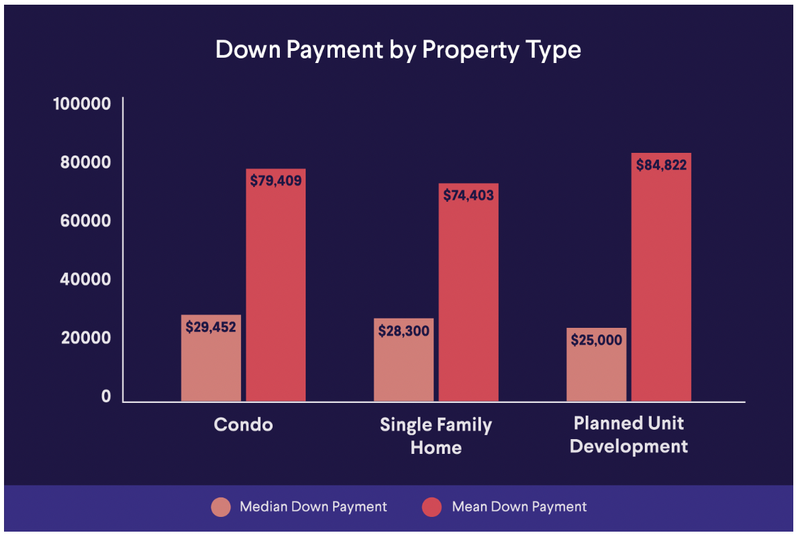

In the second quarter of 2023, Louisiana home buyers made the lowest average down payment of 9.2% at $6,729, while Washington, D.C. Has the highest down payment percentage amount at 20.4%, with a $100,800 median down payment due to the area’s expensive housing market. Many borrowers put down more than the minimum, either through savings, gifts or down payment assistance. The rise in mortgage rates in recent weeks is an unwelcome trend for home shoppers this spring homebuying season.

Family members, such as a parent, sibling or in-laws, can contribute financial gifts to cover all or part of the down payment. The mortgage gift rules vary by lender and program and you may need to use a certain amount of personal funds. Another option is reducing your monthly expenses and saving the difference. Saving for a down payment can be overwhelming since it’s a considerable cost. Here are several tips and tricks to find the funds you need to buy a house.

Many home buyers in California are able to manage the monthly payments on a mortgage loan, but have trouble coming up with the down payment. A couple of years ago, the National Association of Realtors conducted a survey that determined the average down payment among all buyers to be 12%. So this is a good figure to use when measuring the average down payment for a California home purchase, across the board.

No comments:

Post a Comment